Master Servicer,

Back-up Servicer and Calculation agent

Servicer under the Italian Law 130/99

Zenith was the first company in Italy to obtain (in 2004) a rating from Standard & Poor’s to perform as Master Servicer under the Italian Law no. 130/1999 in Structured Finance transactions. Its rating was raised to Strong in February 2013, due to its process of growth and expansion that has characterized Zenith Global on the market. In the role of Master Servicer (or “ Servicer“), Zenith monitors and controls the overall transaction, while portfolio servicing is delegated to a third party (a “sub-servicer”). As Master Servicer, Zenith can carry out the following tasks:

- Verification of the sub-servicer’s organizational adequacy to manage securitized assets

- Monitoring to the transaction’s compliance with contracts and Italian Securitisation Law no. 130/1999

- Monitoring the cash flows and collection activities

- Checking and issuing weekly/monthly reporting

As Calculation Agent, Zenith also calculates the available funds and releases the Payment Report.

ZENITH'S EXPERIENCE IN MASTER SERVICING

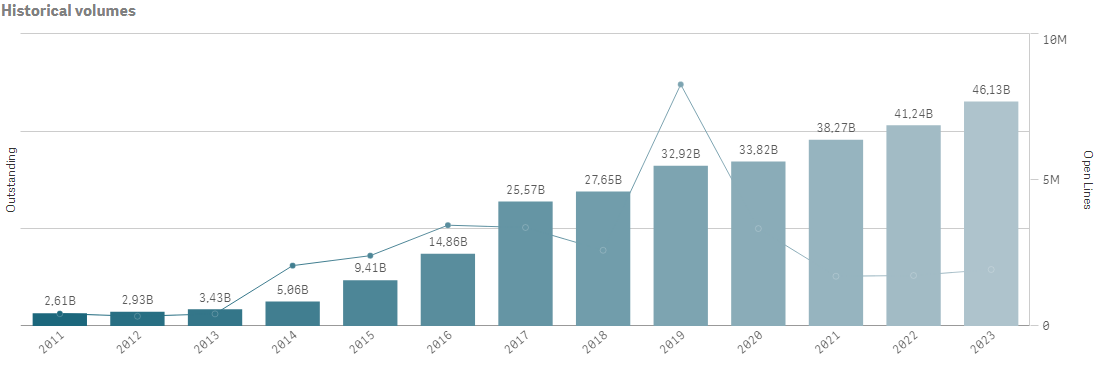

The chart below shows the volumes of the transactions managed (€ 46,1 billions as of December 31, 2023)

Back-up Servicer

Zenith Global was the first intermediary (since 2008) in Italy to act as Hot Back-Up Servicer in structured finance transactions.

In this role, Zenith guarantees that the securitised portfolio is properly managed even in the event of a Servicer’s default. In this case, Zenith makes its human and technological resources available, which are prepared to take over for the Servicer, if needed, at any time.

In light of its experience, Zenith can also act as Back-up Servicer Facilitator, assisting the SPV and the Servicer in the selection of a Back-up Servicer or a Servicer, if needed.